san antonio sales tax calculator

0125 dedicated to the City of San Antonio Ready to Work. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax.

How To Calculate Sales Tax On Almost Anything You Buy

The sales tax jurisdiction.

. 160 San Antonio Ln Nipomo CA 93444 1150000 MLS PI22187056 Two commercial retail lots in a high profile Highway 101 location. The December 2020 total local sales tax rate was also 8250. The current total local sales tax rate in San Antonio TX is 8250.

There is no applicable county tax. The current total local sales tax rate in San Antonio NM is 63750. Calculator for Sales Tax in the San Antonio.

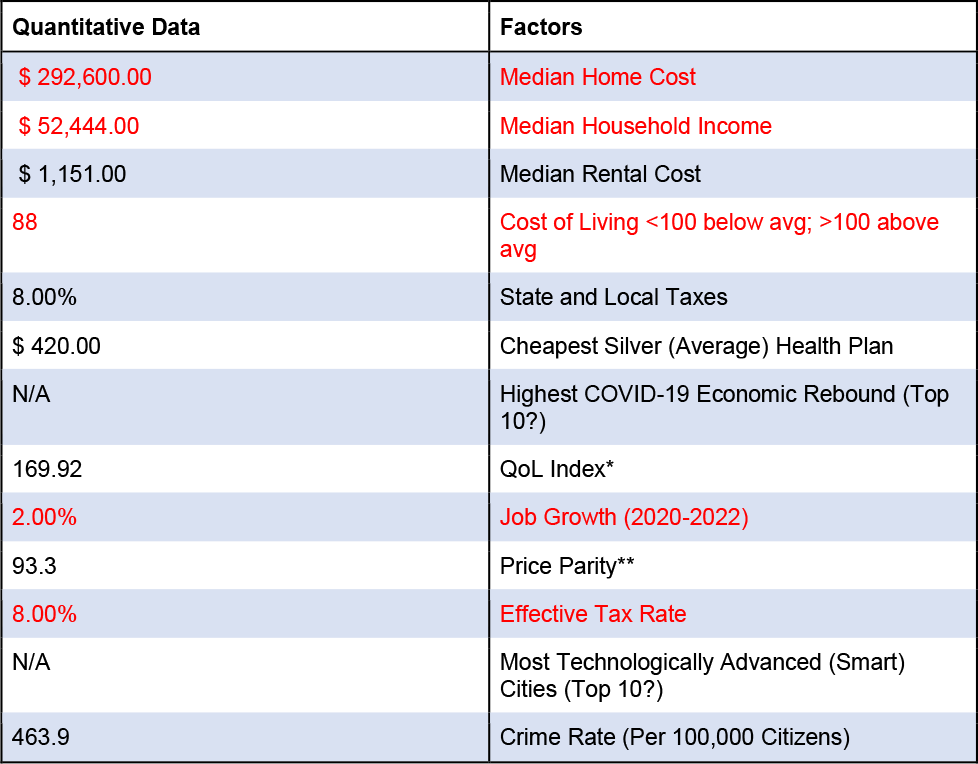

There is base sales tax by Texas. Sales and Use Tax. San Antonios current sales tax rate is 8250 and is distributed as follows.

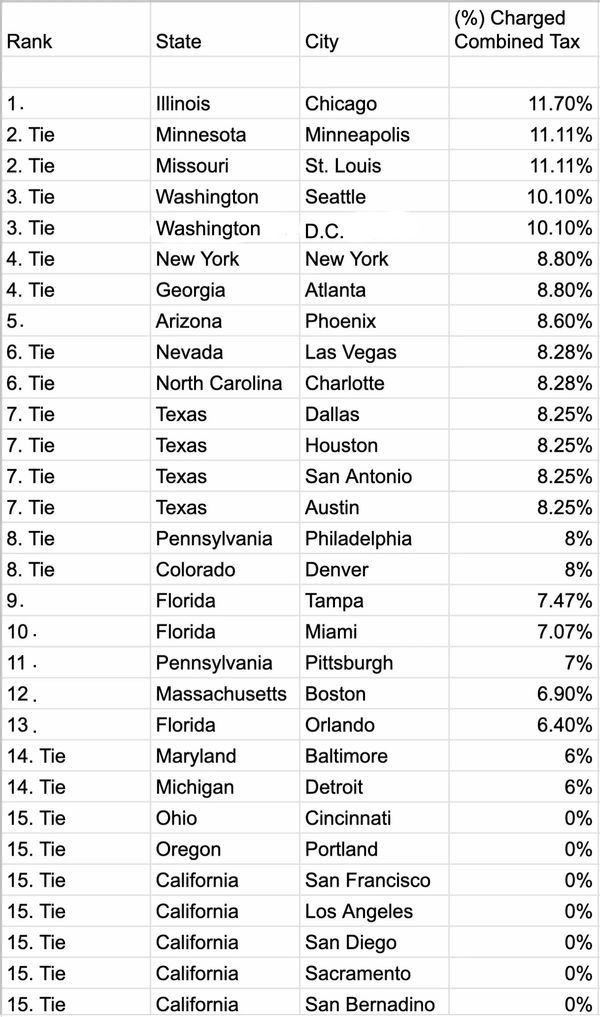

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code. Texas residents 625 percent of sales price less credit for.

Monday - Friday 745 am - 430 pm Central Time. San Antonio Sales Tax Rates for 2022. Texas Sales Tax.

Real property tax on median. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. Input the amount and the sales tax rate select whether to include or exclude sales tax.

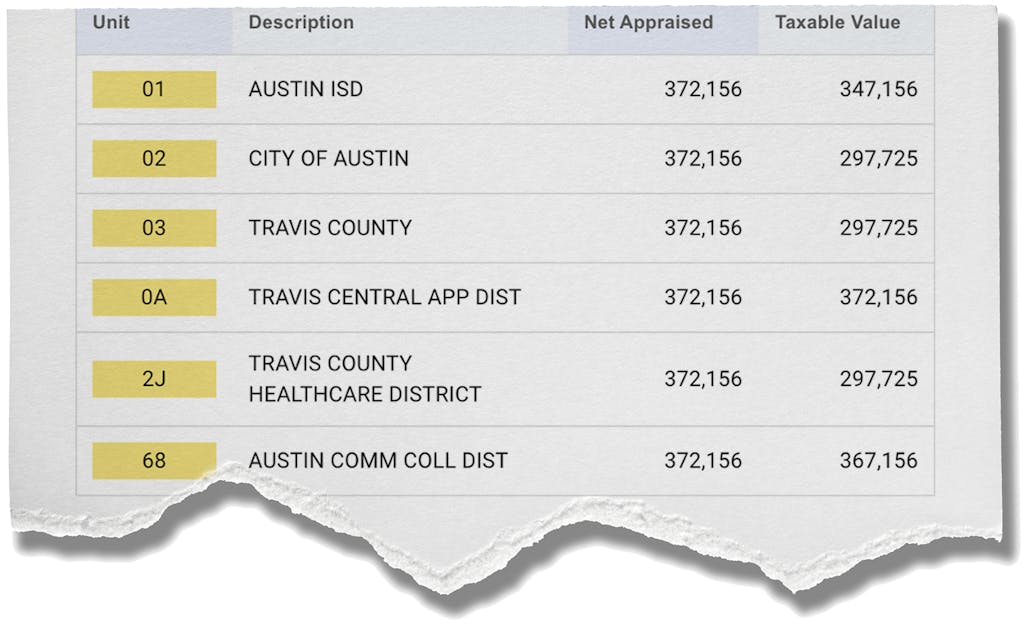

Counties cities and districts impose their own local taxes. 1000 City of San Antonio. City of San Antonio Property Taxes are billed and collected by the Bexar County.

This includes the rates on the state county city and special levels. Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Please consult your local tax authority for specific details.

Sales Tax State Local Sales Tax on Food. The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in San Antonio. San Antonio is located within Pasco County Florida.

The sales tax rate for San Antonio was updated for the 2020 tax year this is the current sales tax rate we are using in the San Antonio. The December 2020 total local sales tax rate was also 63750. Sales tax in San Antonio Texas is currently 825.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. While many other states allow counties and other localities to collect a local option sales tax Texas does. The average cumulative sales tax rate in San Antonio Florida is 7.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. US Sales Tax Texas. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a.

San Antonio TX 78283-3966. The calculator will show you the total sales tax amount as well as the county city and.

Mckinney City Council Adopts Reduced Tax Rate 652m Fy 2022 23 Budget Community Impact

Reverse Sales Tax Calculator De Calculator Accounting Portal

New Mexico Sales Tax Rates By City County 2022

Rental Property Returns And Income Tax Calculator

How Property Taxes Have Changed Skyrocketed In San Antonio Neighborhoods

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

U S Cities With The Highest Property Taxes

San Antonio Nissan Dealership L Ancira Nissan L New Used Repair

Sales And Use Tax Rates Houston Org

Dallas Homeowners To See Biggest Tax Rate Reduction In Decades Under Budget Proposal

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

8 125 Sales Tax Calculator Template

Frisco Isd Lowers Tax Rate For 2022 23 Fiscal Year Community Impact

/images/2022/08/19/businessmans_hand_calculating_invoice.jpg)

10 Worst States In America For Property Taxes Financebuzz

Texas Income Tax Calculator Smartasset

Understanding Tax Rate Discrepancies

Coffee And Community Improvement Districts Unpacking The Mystery Of The 7 Starbucks Macchiato Salon Com